How to Make a Balance Sheet : 7 Steps

Gemeinsam Casino Mit Handyrechnung Bezahlen Neu Zahlungsart

December 14, 2021Contents:

Are cash, cash equivalents, and things that can be easily converted into cash within the next 12 months. Your bank accounts, petty cash, accounts receivable , and inventory are all examples of current assets. Any accounts receivable balances you may have would be placed under the current header as would any inventory you have in stock. Add these totals to arrive at your total current assets amount.

If you have a relatively high ratio, your business has many assets and little equity. So, a high assets-to-equity value may indicate that your business has taken on substantial debt. Depending on the company, different parties may be responsible for preparing the balance sheet. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper. For mid-size private firms, they might be prepared internally and then looked over by an external accountant. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report.

Step 8: Add up liabilities and owners’ equity

Accounts payable includes bills or transactions for which money is yet to be paid to the suppliers or creditors. All accounting software tools generate trial balance as a standard report. You can streamline everyday bookkeeping tasks and ensure bookkeeping accuracy using accounting software. For instance, if you delivered goods worth $5,000 on the last day of the month but didn’t receive the amount until the next accounting period, then you’ll need to adjust your journal entry. Update your accounts by making such adjusting entries in the general journal. You can prepare a balance sheet on your own or hire accountants and bookkeepers to do it for you.

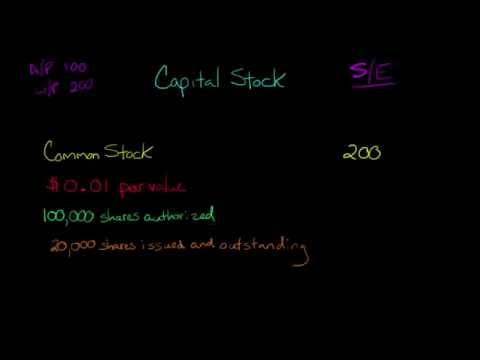

Having your balance sheet readily available to show lenders could be a game-changer. Still, the process of applying for business loans can be challenging and time-consuming. For sole proprietorships or single-owner businesses, net equity is usually called “owner’s equity.” But what does it mean? An owner’s equity is what you’ve invested into the company. If you have shareholders, the equity also belongs to them — whether your shareholders are public or private. All the shareholder equity belongs to you if you’re a sole proprietor.

Shareholder Equity

The https://1investing.in/ is also a tool to evaluate a company’s flexibility and liquidity. The strength of GAAP is the reliability of company data from one accounting period to another and the ability to compare the financial statements of different companies. The standardization introduced by commonly defined terms is responsible for this reliability. To help you get a grip on accounting terminology, terms are defined as they are introduced and a glossary is included for reference. A balance sheet is a formal document that follows a standard accounting format showing the same categories of assetsand liabilities regardless of the size or nature of the business. The balance sheet you prepare will be in the same format as IBM’s or General Motors’.

The preparation and presentation of this information can become quite complicated. In general, however, the following steps are followed to create a financial model. From there, gross profit is impacted by other operating expenses and income, depending on the nature of the business, to reachnet income at the bottom — “the bottom line” for the business. This account includes the amortized amount of any bonds the company has issued.

Step 5: Calculate long-term liabilities

This may refer to payroll expenses, rent and utility payments, debt payments, money owed to suppliers, taxes, or bonds payable. If you want a program that has built-in functionality to help you enter data and make calculations more efficiently, consider investing in an accounting software program. There are a wide range of software programs that cater to users from beginner to advanced, so you can choose one that works for your current skill level. If you don’t already have a basic understanding of accounting, you may want to invest in an advanced software program that does most of the work for you.

How can you insulate your portfolio from a recession? – The Armchair Trader

How can you insulate your portfolio from a recession?.

Posted: Fri, 14 Apr 2023 10:35:55 GMT [source]

Add Liabilities and Stockholder’s account together to get the amount equal to total assets. Include the total amount of all funds that have been invested into the company, as well as any retained income that is kept within the service company for operations. In this section, two types of liabilities will be explained. You will continue to use the worksheet and at the end of this section.

Step 4:

For example, a business balance sheet reports $250,000 in assets, $150,000 in liabilities, and $100,000 in owner’s equity. The creditors have a claim of $150,000 against the company’s $250,000 in assets. Once the debts are paid off, the owner can claim their equity of $100,000. Your liabilities section lists all of your current and noncurrent liabilities. Once you list and assign the values for each, you can add them together to get your total liabilities. Example liabilities include short and long-term debt and accounts payable.

A small business requires a balance sheet to get insight into its financial statement and overall value. It helps the owner keep track of the company’s finances, including assets, liabilities, and owner’s equity. The end goal of the income statement is to show a business’s net income for a specific reporting period.

Let Our CPAs in Raleigh Generate Your Financial Statements

An example of a balance sheet has been attached in the excel file where we can see the asscompany’s ets, liabilities, and shareholder’s equity of ng with all the components under each criteria. For example, if we refer to the excel file, we will find the first part of the balance sheet is the calculation of total assets. Here for the company, we have divided the total asset into two parts, i.e., current assets amounting to $5,000 and fixed assets amounting to $4,500. Thus the total asset is the sum of current and fixed assets, which is $9,500. To make a balance sheet for accounting, start by creating a header with the name of the organization and the effective date. Then, list all current assets in order of how easily they can be converted to cash, and calculate the total.

- As with assets, most balance sheets break down liabilities into two subcategories.

- Additional resources for managing your practice finances will appear in future issues of the PracticeUpdate E-Newsletter and on APApractice.org.

- Also called capital, the equity account represents a company’s net worth.

- The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Last, the forensic accounting defined shareholder’s equity and total liability are added and placed at the bottom of the left-hand side. This total on the right-hand side should match the total assets on the left-hand side. As you know, balance sheets have many uses from giving you a quick snapshot of your business’s financial status to helping you with financial planning. But don’t forget that your balance sheet can help you secure funding from potential lenders and investors!

First, list your current bank account balances , subtract any loans or amounts due to others , and what is left is your equity in the business. Unless you have a very small business, it can be extremely difficult to prepare a balance sheet manually. However, if you are tracking your accounting transactions in separate ledgers, it is possible. First, you would take your current cash account balance and place that under current assets. Assets are usually divided into two categories on your balance sheet, current assets and long-term assets.

Unlike the profit and loss statement, which only shows information for a certain period, the balance sheet shows information as of a specific date. And that information includes a financial summary of your business from its start through the “as of” date on the balance sheet. To create a balance sheet in your accounting software, go to the reports section and look for financial reports. Since it is a common financial statement, the balance sheet should appear near the top of the list, often right after the profit and loss statement. Over time, a comparison of balance sheets can give a good picture of the financial health of a business. In conjunction with other financial statements, it forms the basis for more sophisticated analysis of the business.

- In fact, mastering a balance sheet could make or break a start-up.

- Some companies will class out their PP&E by the different types of assets, such as Land, Building, and various types of Equipment.

- To help you get a grip on accounting terminology, terms are defined as they are introduced and a glossary is included for reference.

- The assets on your balance sheet should always balance with the total of your company’s liabilities plus equity.

- The liabilities should be categorized into both long-term and current liabilities.

Learn when is the most strategic time to hire an accountant. Connect to all your apps with out-of-the-box software integrations. Review the background of Brex Treasury or its investment professionals on FINRA’s BrokerCheck website. Please visit the Deposit Sweep Program Disclosure Statement for important legal disclosures. Get global corporate cards, ACH and wires, and bill pay in one account that scales with you from launch to IPO. The balance sheet should conclude with two columns with corresponding figures at the bottom.